Go Woke, Go Bust

Oh so woke, oh so green, oh so diverse Silicon Valley Bank (SVB) just went bust.

One can go to its website—still up for who knows how much longer—and see that it claims assets of $212 billion. But as they say, the bigger they are, the harder they fall; and SVB makes for the second largest bank failure in U.S. history.

Remarkably, 93 percent of the bank’s $161 billion in deposits are uninsured by the Federal Deposit Insurance Corporation (FDIC), which only covers accounts up to $250,000. And Roku, to name just one whale, had $487 million in Silicon Valley Bank. So, just for starters, a lot of CFOs—the folks in charge of handling a company’s money—are gonna have some ‘splaining to do.

People line up outside of the shuttered Silicon Valley Bank (SVB) headquarters on March 10, 2023, in Santa Clara, California. (Justin Sullivan/Getty Images)

Speaking of ‘splaining, SVB officials will need to answer a lot of questions, including, What role did wokeness play in SVB’s failure?

Another term for wokeness, of course, is ESG, which stands for environmental, social, and governance. ESG is a pertinent question, as there’s a considerable body of economic literature showing that woke investments aren’t good investments. For instance, one study by professors at the London School of Economics and Columbia University finds that:

ESG funds appear to underperform financially relative to other funds within the same asset manager and year, and to charge higher fees. Our findings suggest that socially responsible funds do not appear to follow through on proclamations of concerns for stakeholders.

Shorter version: ESG makes less, costs more, and is a fraud.

Of course, if ESG investing only soothed the conscience of gullible trust-funders, it might be okay. But now, as a big ESG bank goes belly up, we see the danger of systemic risk to the whole economy. That’s what happened when bank failures domino-ed back in 1929.

So, it’s funny, in a not-funny way, that as recently as March 7, Treasury Secretary Janet Yellen was urging faster please on ESG. “A delayed and disorderly transition to a net-zero economy can lead to shocks to the financial system,” she said.

Well, we haven’t gotten to net-zero yet—and we never will, especially with China still building coal plants—but we’ve already had a shock to the financial system.

U.S. Treasury Secretary Janet Yellen speaks at COP26 climate change summit on November 03, 2021, in Glasgow, Scotland. (Christopher Furlong/Getty Images)

Then there’s the question of bailing out SVB beyond FDIC requirements. As The Washington Post reported on Saturday, a “ferocious political debate” has erupted in D.C. over some political fix that could, of course, cost taxpayers many, many billions. On the other hand, a larger and graver banking crisis could damage the economy and cost Biden many, many votes. So, what D.C. will do is an unknown unknown.

Yet in the meantime, if the evidence continues to pile up that woke/ESG is bad business, then it will be hard for financial officers across the spectrum—in banks, investment houses, pension funds, insurance companies, and university endowments—to argue that they can be woke while still upholding their fiduciary duty. That duty is a heavy legal concept, containing significant civil and even criminal penalties if it is violated.

To be sure, plenty have been warning about the dangers of ESG, including House Majority Leader Steve Scalise (R-LA) and also some of those directly tasked with growing and safeguarding pension funds, such as West Virginia State Treasurer Riley Moore. There’s even a new network of right-leaning investment overseers, the State Financial Officers Foundation.

So, now expect a scramble, as all the Emperors of ESG—including Al Gore, Larry Fink of BlackRock, and maybe even Bono—rush to tell us that this is fine. (As for Janet Yellen, we’ll take her gauge later on.)

Okay, back to SVB and its fiduciary duty, which is especially extensive when it comes to federally regulated banks. (Once again, nobody wants another Depression.) Let’s consider SVB’s fiduciary duty as we go through the bank’s own statements. (We can leave for another time speculation about any other legal violations that might have been committed—it is, after all, quite something to blow $212 billion.)

For instance, here’s an SVB headline from January 10, 2022: “Silicon Valley Bank Commits to $5 Billion in Sustainable Finance and Carbon Neutral Operations to Support a Healthier Planet.” Sounds green! But was that the best use of funds? All we know for sure is that CEO Greg Becker chose not to address the fiduciary matter when he said, “Our ability to make a meaningful difference for people and the planet, and to address the systemic risk that climate change presents, is magnified by the outsized impact our innovative clients make.”

Silicon Valley Bank CEO Greg Becker speaks during a panel discussion at the Silicon Valley Leadership Group in Santa Clara, CA, on Nov. 1, 2017. (Anda Chu/Bay Area News via Getty Images)

All that money might have seemed great for some people (not counting, say, the slave laborers in Africa mining green minerals) and maybe the planet (not counting the bald eagles being killed by windmills), but it doesn’t seem to have been great for SVB investors and depositors.

SVB has more to proclaim about ESG:

Our corporate philosophy of transparency and accountability guides our reporting on environmental, social and governance performance with the goal of building trust and evolving our policies and disclosures.

Yes, that’s what SVB is all about, right? Building trust. Although some have a funny way of building it. For instance, it seems that SVB CEO Becker sold $3.6 million in stock on February 27. Did he know something? Did he act on insider information? (There’s a whole ‘nother passel of laws concerning that, and they’re doozies.)

And it gets better. Here’s more green blather from SVB:

We support entrepreneurs and high-growth businesses at the forefront of innovation, helping to advance solutions that create a more just and sustainable world. Our longstanding commitment to innovation, combined with our deep experience supporting evolving technologies, enables us to contribute to a healthier planet via our own efforts and those of our clients.

A good paragraph for Woke Bingo: “just,” “sustainable,” “healthier planet”—so many words to win!

Of course, SVB is also big into DEI (Diversity, Equity, and Inclusion), declaring, “We’re building a culture of belonging with a global workforce that celebrates greater dimensions of diversity.” More Bingo hits. And to get an even better sense of SVB’s DEI footprint, we might consider this (now deleted) tweet from one Christina Qi, who identifies herself as a former hedge fund CEO:

The SVB collapse has been devastating in more ways than one: They supported women, minorities, & the LGBTQ community more than any other big bank. This includes not just diverse events, but actual funding. SVB helped us move one step forward; without them, we move two steps back.

One sharp tweeter responded, “Maybe other banks will take a look at this failure and realize they need to do actual banking instead of virtue signaling.”

Hmm. Was all that virtue-signaling in keeping with fiduciary duty? Is this what the Biden administration might possibly choose to bail out?

Sunlight Is the Best Disinfectant

It’s a challenge to to cut through this spiel; as the song goes, “the information’s unavailable to the mortal man.” Fortunately, to help, we have subpoenas and other investigative tools. So, while the Biden administration might not be interested in digging too deep on SVB, others will be.

Yes, the fate of SVB is a topic for Congressional investigative committees, at least on their Republican side.

One Republican with a good sense of how this could work is entrepreneur-turned-Republican presidential candidate Vivek Ramaswamy, an early woke-watchman. As he tweeted in the wake of the SVB’s fall:

A key cause of the 2008 financial crisis was the use of social factors to make loans (back then, fostering home ownership). When we don’t learn lessons, history repeats itself: did Silicon Valley Bank use ESG factors to price its loans? Roll that log over & see what crawls out.

A key cause of the 2008 financial crisis was the use of social factors to make loans (back then, fostering home ownership). When we don’t learn lessons, history repeats itself: did Silicon Valley Bank use ESG factors to price its loans? Roll that log over & see what crawls out. pic.twitter.com/eRajMga2sO

— Vivek Ramaswamy (@VivekGRamaswamy) March 11, 2023

For people wondering where their funds went—and for others merely curious about how the rich play with other people’s money—Congressional hearings can indeed be instructive. Those curious about how they’ve worked in the past might Google “Pujo,” “Pecora,” and “Enron,” as well as “Lehman Brothers.”

In each of those past cases, we found that financial players were either not as strong as touted or they were outright frauds. We got through each meltdown, but lots of people lost money—and not enough people went to jail.

So, does SVB prove that the green economy is a house of cards? Here in Breitbart World, we might share common suspicions about that, but we might be interested to know that others seem to have the sneaking feeling that we’re right. For instance, the Biden administration(!).

Biden Not Walking the Green Mile Anymore

After two years of relentlessly anti-real energy policies, starting on day one (happily, some of Biden’s worst moves were thwarted by bipartisan opposition in Congress), the Biden administration is reportedly poised to make a sudden shift: to approving a new carbon-fuel development in Alaska. That’s 600 million barrels of oil, which is great news for American energy consumers (which is all of us, whether we admit it or not). But that’s also 9.2 million tons of CO2 into the atmosphere, which is a downer for greens. Why the shift toward Big Oil?

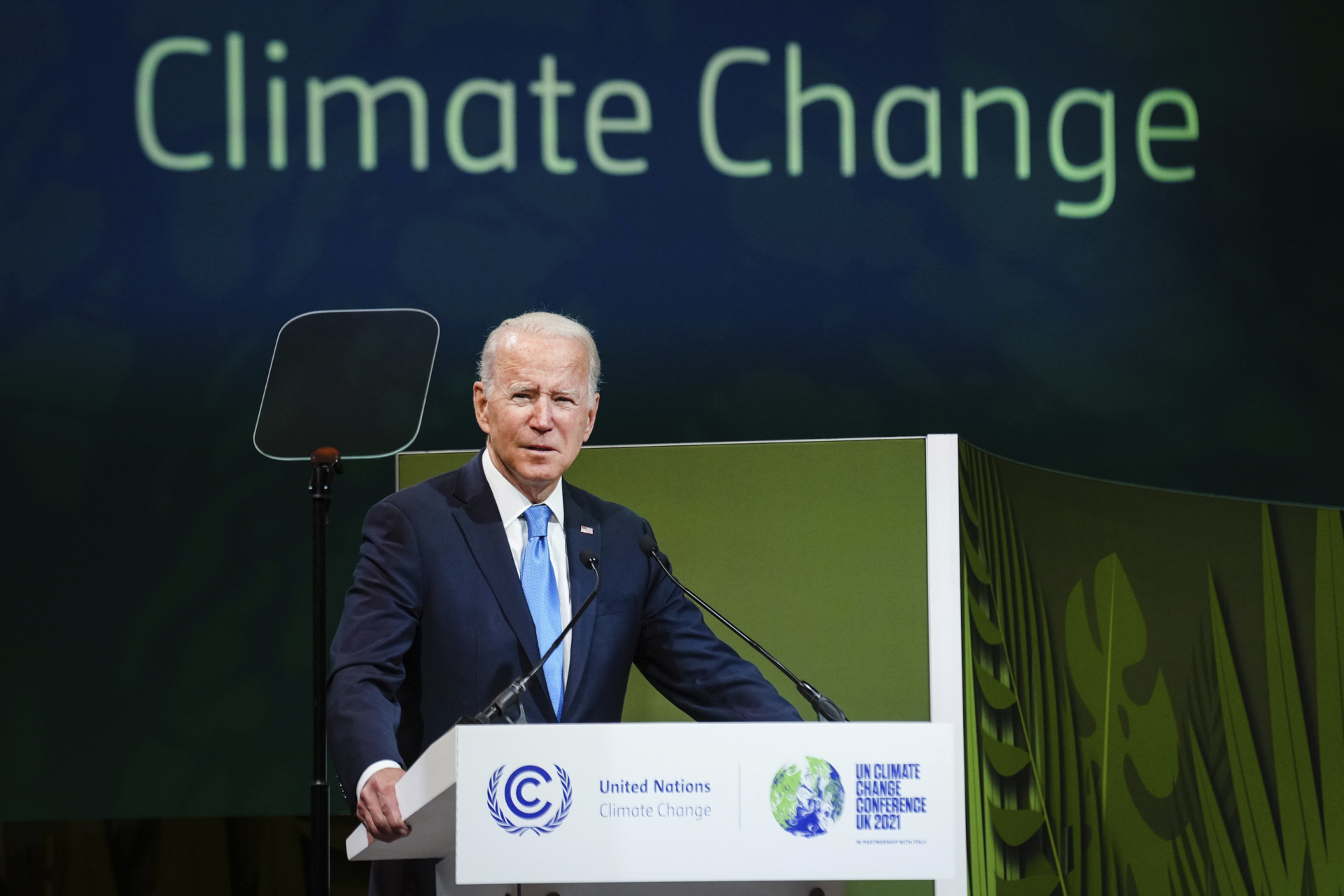

President Joe Biden speaks at the UN Climate Change Conference COP26 in Glasgow, Scotland, on Nov. 2, 2021. (Erin Schaff/The New York Times via AP, Pool)

Politico Playbook punned its answer as “Biden’s crude move to the center”—as in, the center is where you get re-elected. Politico added that it was “another policy development from the Biden administration that is causing agita on the left, this time from environmentalists.” (The most notable other left-agitating development being Biden’s acquiescence to the Republican crime bill.)

The moral of this story is that Joe Biden really, really, really wants to get re-elected. And he’s good at that. It happened five times in Delaware. So, if that means leaving ideological greens in the lurch, he’ll do that faster than you can say “flip-flop.”

The question of bailing out financial greens (SVB’s large depositors and investors) is trickier. After all, many of them are donors to Biden’s campaign. If the Biden administration thinks it can help them and hide the financials somehow from the public, he’ll do that faster than you can say “flim-flam.” The whole Biden clan has proven able at that.

So, can Joe Biden follow his re-election formula nationwide in 2024? We can’t yet know. But if you see Janet Yellen saying, “Drill, baby, drill,” you’ll know that he’s giving it his best.